You could merge 1stHomeIllinois that have a thirty-season repaired-rates FHA, Va, USDA otherwise traditional mortgage. Moreover it brings a grant of up to $eight,five-hundred to help with the advance payment and you can settlement costs. Can’t afford to spend it straight back? So long as you inhabit your house for around 5 years, this new grant try forgiven.

Truly the only catch to possess 1stHomeIllinois is that you must be to shop for a house into the Boone, Make, DeKalb, Fulton, Kane, Marion, McHenry, St. Clair, Will or Winnebago areas. Even though you weren’t expecting to proceed to one among them counties, this choice need to make them lookup alot more glamorous.

Government Earliest-Time Homebuyer Apps

Now let’s fall apart some federal homebuyer apps available in order to people, for those who can’t find what you’re looking for which have the fresh new Illinois programs, or if you need a lot more advice. It would be a good idea to envision each other government and you will condition alternatives whenever conducting your own financial research to maximise your own potential recommendations while increasing your chances of affording your house you prefer.

FHA Financing

Brand new U. When you’re antique financing want an effective 20% down payment, possible just need to lay 3.5% of your own the newest house’s worthy of down in the course of purchase having a keen FHA loan, offered you’ve got an effective credit rating and you can credit records.

To help you discovered maximum masters, needed a great FICO credit rating with a minimum of 580. In case the get is lower, you’re going to be necessary to make a deposit nearer to 10%, which is still 50 % of a frequent down payment. Despite the credit get needs, an FHA mortgage is one of the trusted government applications personal loans in Fort Worth to help you qualify for.

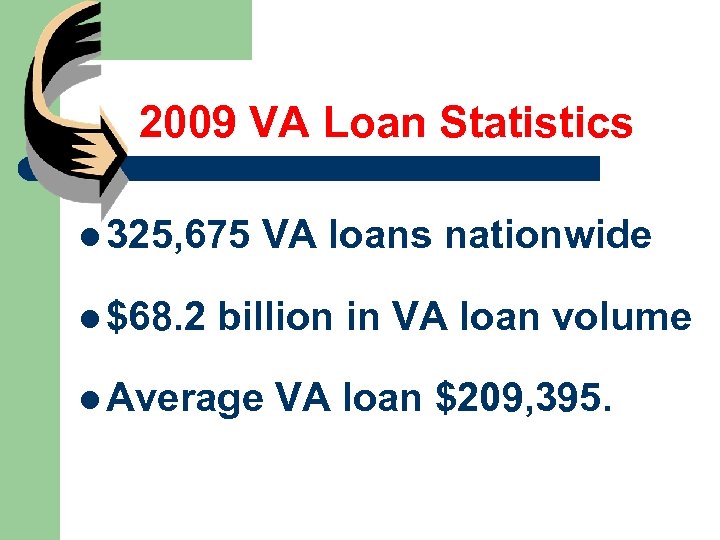

Virtual assistant Fund

The brand new Agency out-of Pros Activities insures Va loans, however, 3rd-people lenders give them. It target a common monetary condition certainly one of military categories of bringing entry to mortgages. They don’t wanted one down payment otherwise personal mortgage insurance rates (PMI).

So you can meet the requirements, you may need an effective FICO credit history with a minimum of 620 and you will probably have to pay a Va money percentage. These can variety between step one.25% so you’re able to dos.4% of your own home’s worth, based whether or not you will be making a deposit. In addition will have to meet with the provider requisite in a single of them indicates:

- Your served 6 decades in the National Shield or Reserves

- Your served 181 times of effective services throughout peacetime

- Your supported 90 straight times of active obligations during the wartime

- You are the mate of an assistance affiliate who has got passed away on distinct duty

As well as the funding fee, there are little or no almost every other extraneous costs attached to good Va loan. And, closing costs were cheaper than those of antique and other mortgage loans. These first deals makes it possible to coast enhance finances and you will help save a great deal more for future years.

USDA Finance

Money from the All of us Company away from Agriculture, being lawfully known as the Section 502 Unmarried Family members Construction Protected Mortgage System, try to focus homebuyers so you’re able to rural, otherwise partial-rural, metropolises regarding the You.S.

For as long as your credit rating is decent, you don’t have to pay one downpayment toward an effective USDA financing. If for example the credit score falls sometime straight down to your FICO size, you may have to shell out a down payment of about 10%. That’s nevertheless somewhat below an average 20%.

There can be one to extremely important needs to keep in mind, even in the event. In order to be eligible for a common USDA loan from the protected financing system, family income need to lay inside 115% of median income with the town we wish to alive from inside the. This will be a great dealbreaker for a two fold-income loved ones looking to buy a home for the first time.